What DeFi is and why you should care.

To understand Decentralized Finance (DeFi) and why it exists, it’s essential first to understand the purpose of “Traditional Finance” (TradFi), particularly as it relates to the capital market. This is necessary because, for the most part, the capital market is what DeFi disrupts today.

Finance in this context refers to channelling financial resources from suppliers of capital (people who have more money than what they need to spend immediately) to people who need capital, such as businesses and governments. For instance, if you have $2,000 saved up and a business needs $100,000 to run, the job of the players in the capital market such as banks and stockbrokers is to figure out how to collect this money from you — through products like savings accounts and pension funds — and give it to the business that needs capital. Ideally, the business uses the funds productively and then gives you some of the returns generated.

Because this activity of aggregating and facilitating the free movement of capital is critical to modern economies, there are usually opportunities to earn money. Historically though, only a few entities have been able to participate in unlocking financial value directly in this way. This is because finance is a heavily regulated sector, and understandably so.

Problems with TradFi as it exists today.

While “protecting” the populace seems like a good thing, governments and the entities that serve as middlemen are not always run efficiently and in the interest of “everyday people”. So, it is not uncommon for markets to be riddled with discriminatory policies and bureaucratic inefficiencies. Here are a few of the problematic consequences of how financial markets are organised today:

- Geographical barriers lead to inefficient capital allocation: When capital flows freely within an economy, it can be deployed to more productive uses that increase its value and bring wealth to capital suppliers. As the world becomes more interconnected, these benefits should extend across the globe. However, in most markets today, there are substantial geographical barriers around the movement of capital that exist simply because governments say so. The current system often means that money cannot move from the places where it is abundant and idle to areas that need it the most without extensive paperwork, tons of intermediaries and high fees. For instance, it’s nearly impossible to buy stock in a Vietnamese public company if you live in Ghana.

- Those most affected by decisions cannot contribute to policy: In a centralised system, regulation is enforced “top-down”, and end-users don’t have a choice because they’re bound to the financial markets within their countries. While in some parts of the world, citizens can trust their governments to make decisions in their best interest, this isn’t the case in most countries, and citizens end up bearing the brunt of arbitrary policy decisions. Even when the policies aren’t outrightly discriminatory, middlemen’s enforcement can exclude minorities and low-income earners.

- Misalignment of incentives: The middlemen who facilitate trade in capital markets are profit-making businesses themselves who will take actions that earn them the highest profits even at the long-term detriment of their users. There is ample evidence that one of the critical contributing factors in the 2008 financial crisis in the US was the compensation structure in the mortgage and investment banking industries that favoured excessive risk-taking.

- The slow pace of innovation: While technology is used in several processes in TradFi (i.e. Traditional Finance) today, there’s still a limit to how it can be applied due to restrictive regulation and different standards of handling transactions. Bundling financial products and services across diverse markets is near impossible, and even when it is, it is prohibitively expensive.

DeFi and how it attempts to solve market inefficiencies

Decentralised Finance is an application of blockchain technology that uses math, cryptography (the study of secure, private communications between parties) and economics to create and maintain financial markets without requiring a central “trusted” entity, like the government. Transactions are recorded and validated through a network of computers worldwide in a way that isn’t changeable. As a result, any two parties can transact on the network without a mediator, and it will be secure and verifiable. Currently, most DeFi applications are built on the Ethereum blockchain, but they can be built on any other programmable blockchain, e.g. Solana and Binance Smart Chain.

How markets are governed in DeFi.

In DeFi, markets are coordinated through openly auditable code called smart contracts. A smart contract is a program that performs a given set of predefined actions on the blockchain. It is “law” once deployed and will consistently execute as written. When you send your cryptocurrency to a DeFi protocol (a software program made up of one or more smart contracts), you’re not trusting your money to a person or entity but rather to the contract.

For instance, a developer can write a smart contract such that when it receives a deposit of Ether (ETH) from Alice, it lends it to Bob after verifying that Bob has another crypto asset (e.g. USDC or an NFT) as collateral. It then returns the ETH and some interest to Alice when Bob pays back the loan (e.g. the ETH borrowed) or sends the collateral (e.g. if USDC is used) to Alice if it doesn’t receive the repayment from Bob after an agreed period. This is an example of a decentralised lending process.

Most of the smart contracts in use by DeFi protocols today are generally more complex than this and factor in the activities of thousands of participants and user groups. Rather than force them to comply with the rules through the threat of jail time, smart contracts are designed to align the incentives of the different actors such that compliance ends up being in the actors’ own best interest and is the only worthwhile option.

Provided that the smart contract is bug-free, it will continue to execute these sets of instructions whenever it is triggered. All code deployed to the blockchain is publicly visible, so anybody with the technical skills can verify that a smart contract does what the developers say it does.

What it looks like when you can choose your government.

For a person to participate in DeFi, they have to self-custody their assets using non-custodial wallets. This essentially means that they have full control over their funds and aren’t bound to any provider or third party. They can easily switch to other providers if they’re not satisfied with the service. As expected, having low switching costs breeds healthy competition in terms of better returns, capital efficiency, and more innovation — all of which ends up being better for end-users.

Innovation is made much easier because all code on the blockchain is open-source and accessible to everyone else. People can easily build on top of things that already exist. We can think about any DeFi protocol as a lego block that can be combined with others to create something new. This idea is often referred to as composability. People can “copy” all code from an existing protocol ( called ‘forking’), improve the code, and then deploy it to the blockchain. Anyone, anywhere in the world, can build on these blocks and make different kinds of financial products accessible to people everywhere.

DeFi makes it possible for everyone to have a say.

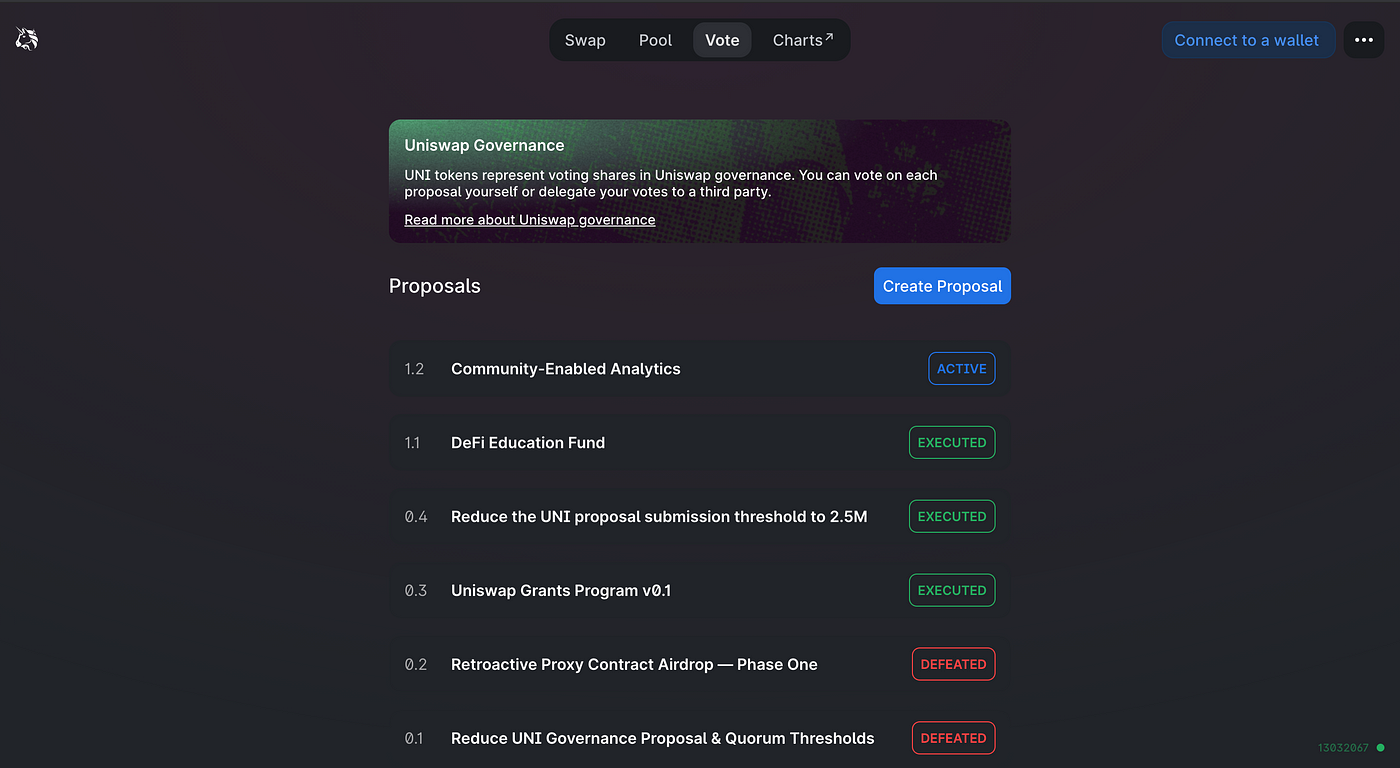

Several DeFi protocols are organised as Decentralized Autonomous Organizations (DAOs). While discussing DAOs is beyond the scope of this article, in this context, it means that some DeFi providers give their users tokens that represent voting rights in how the protocol should run.

An example is Uniswap’s governance token, UNI. Token holders use these tokens to vote on the future of the Uniswap protocol, how the transaction fees on Uniswap are spent etc. Most of these tokens also have some market value and can be traded on other exchanges in the same way stocks are.

Here are some of the ways that DeFi is being used presently:

Borrowing & Lending: Because there are no geographical barriers to using DeFi protocols, capital can flow across the world efficiently. A user in Nigeria can lend money to someone in Tokyo and securely earn interest over the internet without an intermediary. There’s a broader pool of capital that anybody can tap into from anywhere in the world. Examples of DeFi protocols that currently offer this are Aave, Compound and Dharma.

Decentralised Exchanges: Decentralized exchanges (DEXs) facilitate the exchange of assets between two parties without an intermediary. All of this activity happens over the blockchain and is open to everybody to participate. There are no restrictions around geography or human biases involved. Popular DEXs across different blockchains are Uniswap, Pancake Swap, Sushi Swap, Serum etc. You can read more about DEXs here.

Stablecoins: One of the major issues that people face with cryptocurrency is price volatility. There are several use cases where it’s vital to have a high degree of stability in the value of an asset or currency. For those cases, we have stablecoins. A stablecoin is a cryptocurrency whose value is kept stable, usually by pegging to the value of another asset. It enables people to transact assets with a known value, such as fiat currency, company stocks, real estate etc., on the blockchain.

USDT & USDC are two of the most popular stablecoins in the world. They are cryptocurrencies pegged to the US Dollar and can be used for transactions on the blockchain. E.g. you can put up your ETH as collateral and borrow USDC to use for some other commerce.

Development of new Finance models: Because of how low the barriers to build and innovate in DeFi are, there is a lot of room for experimenting with different new models of finance.

An interesting example that’s pretty popular in crypto is trustless “No-Loss Lotteries”. A protocol that offers this is PoolTogether. The protocol pools together a fund from users and invests it in another protocol that bears interest (remember composability ;)) for a given period. In the end, it automatically returns the capital to each user and sends all of the yields to one random (lucky) user. All of this is done on the blockchain, so it’s transparent, and there’s no need for a trusted intermediary.

What’s missing with DeFi

While there’s a lot of growth happening in the DeFi space (DeFi Pulse estimates that there is over $80 billion locked in DeFi protocols), there is still a lot of work required to get it to the point where more people can use it as a replacement for TradFi services. The breadth of work that needs to be done spans user experience, risk management and scalability.

Many DeFi interfaces come off as intimidating for newbies, and participating in even the most simple ones requires some reading and familiarity with non-custodial wallets and transactions. This is even more critical when we think about how costly mistakes can be in the space; transactions on the blockchain are mostly unchangeable, and users can lose a lot of money if they make mistakes.

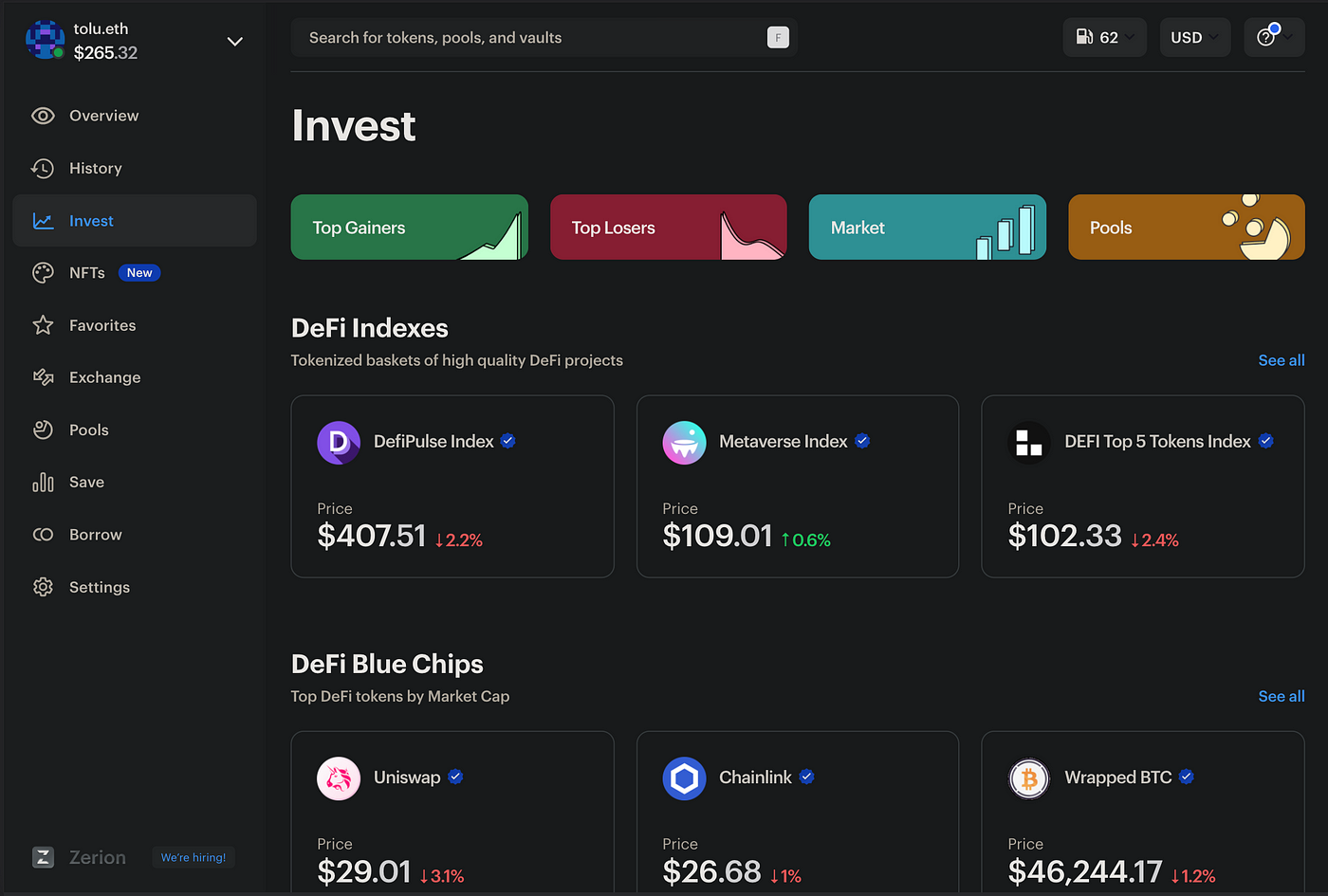

However, there continues to be a lot of effort and resources directed to improving UX and helping users manage risk. Several new platforms such as Rainbow, Zerion and Zapper enable users to engage with thousands of DeFi investment opportunities in a simple, user-friendly interface. If you’re new to DeFi, you should start with one of these.

On scalability, as demand increases on blockchains like Ethereum, transactions become increasingly expensive and slow. This has happened particularly over the past year as DeFi, and NFT projects have become more popular. Thankfully, there are several solutions to these scaling issues that are being explored and deployed in parallel. An example is Optimism, which completes transactions in a few seconds and makes them over ten times cheaper. Other blockchains are competing to make transactions faster and more affordable.

Final Thoughts

A common line of thought is that most DeFi activity is speculative, mainly because of the prevalence of tokens that people refer to as “shitcoins” or “meme coins”. While this may be true on the surface, on a deeper level, there’s a lot of financial infrastructure being built through all of this that will last long after the purely speculative days are over. A good explanation I’ve seen about this is the Gartner Hype cycle that describes how new technology becomes mainstream. The amount of capital flowing through the space intentionally or unintentionally attracts some of the best minds and resources to build. It incentivizes them to re-imagine finance without borders and restrictions and build it out so that anybody can use it.

It’s true that DeFi is still somewhat clunky, slow, expensive and not entirely user friendly. This isn’t unusual for new technology. Computers seemed far less user-friendly just a few decades ago, but here you are, reading an article over the internet on a flat screened device that fits in your palm.

Financial systems are broken today and don’t always serve our increasingly interconnected world in the way they should. Although it seems naive to try to rebuild global finance systems that aren’t dependent on the government, it’s an ambitious effort that could end up revolutionalizing financial markets as we know them today. We can uncover new, exciting ways to organise economic resources that are more efficient and inclusive and build from the ground up. The possibility of achieving that is fascinating and worth the growing pains, in my opinion.